Reviewed by Prabhakar Shetty, practising advocate at the Karnataka High Court

Before buying any property, you need to investigate all documents provided by the current property owner, and authenticate these with the agencies issuing the documents.

There are two kinds of documents to check for — primary and secondary documents of title. Primary documents of title are the most essential as they show the ownership history of the property being sold.

Some of the secondary documents of title help corroborate the information mentioned in the primary documents. The other secondary documents help the buyer assess whether the building is compliant with regulations and has been built according to plan.

Following are the primary and secondary documents of title.

Primary documents of title

- Parent deed

This is the Sale deed, Gift deed, Partition deed, Allotment letter or similar, by which the present owner(s) have acquired the title to the property. This document is also referred to as the Mula Pathra, and includes the unbroken flow of the title up to the present owner.

Tracing of the title should always begin with the earliest available document, record or order by which a court, government or statutory authority gave the rights to the property to its first owner. Then, documents which identify the subsequent owners of the property through an unbroken sequence of legal acts up to the present owner, i.e. the seller, should be traced.

In some cases, many of these documents may have been lost over time; then the buyer should look at the earliest registered document available with the seller, and trace the title up to the present owner with the help of a lawyer. Since almost all properties in Bengaluru have their roots in agriculture, it is possible for the lawyer to establish whether the property has clear titles and if it can be legally sold based on the secondary documents mentioned below.

Secondary documents of title

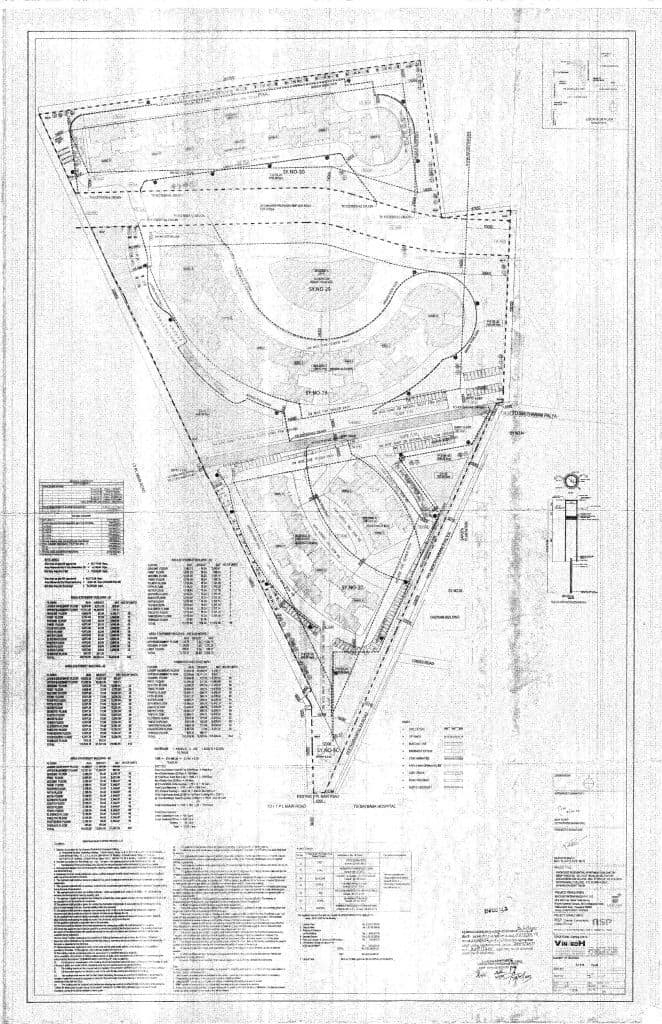

- Building plan sanction

In case of apartments and individual houses, you need to have a Building Plan Sanction issued by the BBMP, BDA or the village panchayat in whose jurisdiction the property falls.

In case of vacant sites in layouts, you need to check for the layout plan sanction issued by the plan-sanctioning authority. For builder-developed independent homes, apart from the layout plan sanction, you need to have the building plan sanction from the BBMP or the concerned village panchayat.

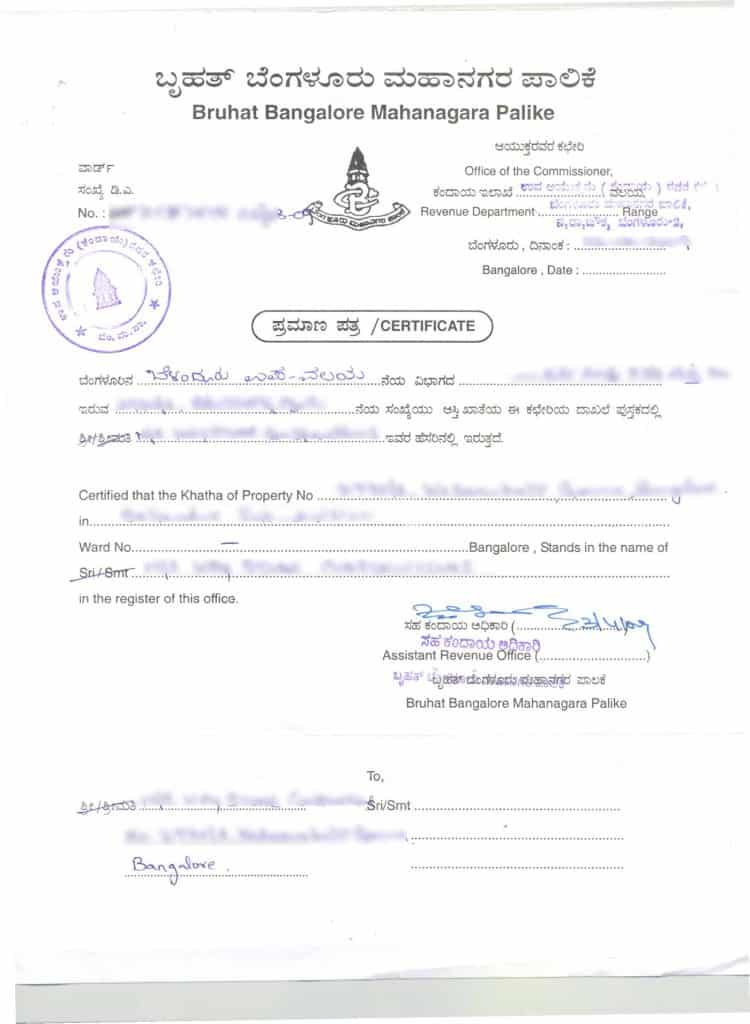

- Khata

The authority that registers a property transfer has to send the registration document to the local body (BBMP or village panchayat) for further action. BBMP/panchayat then opens an account of that property in the name of the registered owner once the owner submits an application and the prescribed fees. The register in which such accounts are maintained is the ‘Khata register’.

There is no specific mention of the term Khata in the Karnataka Municipal Corporation (KMC) Act of 1976; it is only an assessment register which compiles the details of each property in the city. The term Khata is a colloquial term and literally means an ‘account’. Thus, the Khata is an account of every person who owns a property in the city. You need to get a Khata certificate and Khata extract from the BBMP.

a) Khata certificate

The Khata certificate issued by BBMP will mention that a particular property number ‘N’ is held in the name of person ‘X’. The description of the property as well as tax assessed/paid will also be shown in the certificate. This certificate is required for applying for a water connection, electricity connection, trade licence and building licence. BBMP will give the certificate only to the owner of the property or to their legal heirs.

b) Khata extract

The copy of the particular page in the Khata register in which your account is maintained, is called the Khata extract. It is issued by the BBMP, and states the name of the property owner and details of the property such as plot size, built-up area, etc. The owner can get this document by paying Rs 100, along with a requisition letter to the concerned Assistant Revenue Officer at BBMP’s zonal office. Only owners can collect Khata extracts.

Together, the Khata certificate and Khata extract are unofficially called the ‘A Khata’.

- ‘B Khata’

To include unauthorised layouts, revenue sites as well as buildings constructed in violation of by-laws into the property tax net, a provision was made under the Section 108A of the KMC Act. Details of the tax collected from such properties are maintained in a separate register called the B register. Development charges are not assessed/collected from these properties.

- Encumbrance certificate

Encumbrance Certificate means a certification of the record(s) of all registered transactions over a property – sale, mortgage, court attachment, lease, etc., or the absence of these.

If the land was agricultural land earlier, you need to have the Conversion Order. Conversion Order is an order for converting agricultural land into non-agricultural use; it is usually issued by the Deputy Commissioner after inspection and upon payment of fee to the state treasury.

4) Tax paid receipts

These are receipts issued by the BBMP, BDA or village panchayat, recording the payment of taxes for the property.

5) PTCL endorsement

The buyer can ask the builder/seller to get a Prevention of Transfer of Certain Lands (PTCL) Act endorsement. Either the Tahsildar or DC can issue this document. This is to ascertain that the property is not on land that had been granted to person(s) belonging to SC/ST communities.

6) Land acquisition

The buyer can ask for an Endorsement from the Special Land Acquisition Officer of the BDA, BBMP, National Highways Authority of India (NHAI), the Karnataka Industrial Area Development Board (KIADB), Karnataka Housing Board (KHB), Bangalore Mysore Infrastructure Corridor Project and others, confirming that there are no acquisition proceedings underway with respect to the property.

7) Family tree

This document shows the genealogical tree in the form of a flow chart, with the name and age of the family members of the present and past owners of the property. It also indicates whether the persons mentioned in it are living or dead

This document is certified by the Village Accountant or the Revenue Inspector. But you need to exercise caution as these authorities sign the certificate with a qualification that they do not take any responsibility as to the truthfulness of the document.

8) General Power of Attorney

A General Power of Attorney (GPA) is a notarised document which empowers another person to act as your legal representative. A GPA executed by a person living outside India should be notarised in its country of origin, and stamped in India within four months of being notarised.

If the GPA is executed within India, it’s enough for the GPA to be notarised. (GPA had to be registered earlier; but the Supreme Court has ruled that it is sufficient if the GPA is authenticated by a notary public.)

However, if many people buy different sites based on a single notarised GPA, each will get only a Xerox copy which won’t be admissible as evidence in court. Whereas if a GPA is registered, every person who buys a different property based on same GPA can get a certified copy, and each such certified GPA will have the same value as the original one. But its authenticity should be separately checked, as impersonations are rampant.

As a buyer, you need to ensure that the GPA is valid, not revoked, and is provided by the person who has the legal right to give it.

It is important to have a competent and independent lawyer scrutinise all the property-related documents to ensure the property has a clear title.

[This article was originally published in the book ‘Buying, Renting and Investing in Property in Bengaluru’, and has been reviewed and updated by Advocate Prabhakar Shetty. In Part 3 of this article, we look at the documents to check before buying certain specific kind of properties such as apartments, BDA sites, etc.]

In Bangalore, normal checking of all documents as stated in this article is not good enough. Many transactions may take place against good looking forged documents too. If you are planning to buy any property, you must use every ingenuity of your to ensure that you don’t get into trouble after purchase, may not be even immediately but may be even after a few years. And one most important suggestion to any buyer from me is “never ever enter into an agreement” with the seller and pay any advance. If the seller is genuine and you have reached an understanding, go ahead straight away to the Sub Registrar abd register the sake deed.

While buying a KIADB alloted plot to an concern should the legal heirs sign/give concent for such a sale or can it be purchased from the seller /propretor

Pls advice

I lost a property which was bought through a medical housing society in Bangalore along with many other doctors, more than a decade back. We were not informed that the property hypothecated to a bank. The bank subsequently took back the property through the Debt Recovery Tribunal.

This, i am told, could have been avoided if we had given a public notice in the newspaper and other platforms.

Thank you so much for a very very detailed input..regds AB

Really this helpfull but not 100%,

If need to check geniunity some more deep execution is necessary, forged documents are more difficult than genuine to find out,

Step one sale deed copy as per CD no,

Step two EC up-to date

Step three khatha bifurcation done from builder or layout developer name to individuals buyer name possible or not [if authority noc found only it’s possible, in 60×40 site apartments are illeagle then not possible to transfer khatha]

Step four Tax paid receipt should be check with authority if BBMP, gramatana panchayity office, or BDA etc..

More over don’t believe blindly any one while investing life time earnings, especially your own friends and relatives who are head weight or egoistics show off person, this crooks if they don’t know anything also only for thier silly show off reason acts like expert in land and law, finally they will push you to swim in waterless well

In absence of proper Town Planning Act in Karnataka leading to haphazard development leading of irregularities and non compliances. For common citizen, it is the most tedious to get Khata Transfer and obtaining compliances from developers in Bangalore. Moreover, Really painful for common people to face BBMP, BDA, BWSSB due to overlapping of jurisdiction and as a result, most of the NGOs used to intervene.

This information is very informative and helpful. Some more details are expected from the author for the common man. Thank you.

Is it possible for builder to change the layout after selling all flats

In our case builder gave us possession 2 Years back but did not give OC, later we protested and demand for OC but instead OC he has got approval to extend the project and started development on neighbouring side, new plan shows is modified with extension where he has broken the boundary wall to merge the new project with the current apartment where more than 200 owners are living here, now we are clueless as builder has approval to made change for our project, we feel cheated as he has not taken our consent